The introduction of serialization or track and trace legislation has been driven by global demand for increased patient safety, by shaping a more secure supply chain that puts patients front of mind for drug manufacturers and their partners.

But while achieving this alone is sufficiently deserving of dedicated resource and investment, there are significant returns to be had beyond compliance.

The introduction of serialization allows the pharmaceutical industry to take a crucial step towards connecting the entire supply chain from manufacturer to patient. Through this connectivity,businesses can gain transparency of their supply flows and access to data that can be used to streamline operations and logistics. But, while many manufacturers, wholesalers and contract providers are exploring the basic potential of this heightened data access to make more of their serialization investment, only few are looking to implement additional services or processes, such as aggregation, that will make the data flow and its collection easier and more efficient.

In this article, Dexter Tjoa, Director Corporate Strategy at Tjoapack, discusses why aggregation should be considered as the next natural phase in the evolution of the pharmaceutical supply chain. He offers an insight into the opportunities it presents the pharmaceutical industry to further improve processes and quality and highlights why companies should not wait to implement aggregation as part of their serialization solution.

Legislative landscape

Aggregation, in the context of serialization, is the practice of gathering all serial numbers on a single level(for example finished packs) and grouping these under a unique identifier of a level higher (for example a shipper case). In other words, it is building a parent-child data relationship across all three levels of packaging from unit dose to pallet to avoid unpacking an entire batch as it moves through the supply chain.

At present, aggregation is yet to become the market standard in the US or in the EU. And, although three-tier aggregation will be introduced by 2023 in the US as part of the rollout of the Drug Supply Chain Security Act (DSCSA), US companies have been slow to adopt aggregated solutions given the perceived amount of time available before the deadline. In the EU, on the other hand, aggregation is not part of the European Falsified Medicines Directive (FMD) legalisation.As a result,many companies supplying to the EU are in no hurry to adopt aggregation as part of their serialization solution.

Wholesaler needs

While many pharmaceutical companies supplying the US have stated they intend to meet the minimum standard of the DSCSA legislation and will not begin aggregating drug product until the 2023 deadline, the market demand for aggregation services is growing, creating a disjoint between supply and demand.

The drug distribution community in the US – namely the biggest drug wholesalers – has repeatedly stated its requirement to be supplied aggregated goods, stating it will not accept the practice of inference– or presumption based on reasoning– rather than collection-based data. The main reason for this is the problem of saleable returns verification. As a Healthcare Distribution Alliance (HDA) analysis (1) shows, approximately 60 million units of drug product are returned annually in the US alone, with an estimated value of $5–10 billion. Traditionally, there has been little-to-no dedicated regulatory involvement, but from November 2019, the DSCSA will dictate that for a product to be re-sold, the wholesaler must verify its serial number, lot number, GTIN, and expiration date. The check is similar to that which is carried out at the point of dispense (POD). This makes aggregation invaluable for wholesalers, providing the only alternative to opening group packages (bundles, cases, or wrapped pallets) and verifying all the consumer packages it contains one by one. Allowing the wholesalers to verify all unique identifiers at once, aggregation enables them to re-sell the product quickly and cost effectively.

TheEU FMD’s risk-based verification requirements poses similar problems. The directive dictates that wholesalers, in some cases, must verify products by scanning their barcodes before selling the product on. There are several instances that require them to scan unique identifiers (UIs) to make sure products are genuine. This includes returns from pharmacies, hospitals, or other wholesalers where verification of UIs is needed; exporting to outside the EU;cases in which product lots are spoiled as a result of a break in cold chain storage; and mass verification and decommissioning of UIs.Without aggregation, wholesalers will have to unpack each batch and scan packs individually in every one of these scenarios. Receiving aggregated data for each shipment will offer an increased level of operational efficiency,which will inevitably offer both time and money savings.

Efficiency by default

In acompetitive market environment, where wholesalers are demanding aggregated product from multiple suppliers who are offering a similar drug, companies who can offer aggregated products will have a competitive advantage over those who do not. For many products, this alone can be a sufficient business case for covering the cost of aggregating a product line. However, in addition to external factors, such as market demand from wholesalers, there are also internal motivations to encourage companies to adopt aggregation solutions, such as potential efficiency and quality gains. If companies want to realise the full benefits of serialization, aggregation must be incorporated into their supply chain.

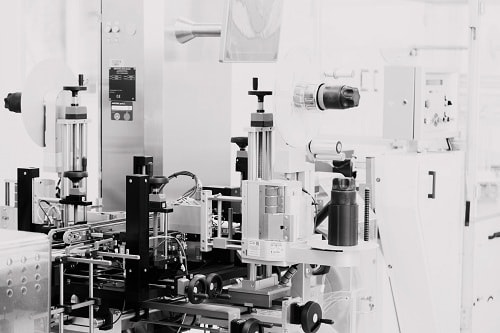

For many years,automated inline vision inspection has been used for item verification as well as lot and expiration code inspections. By implementing aggregation, operators gain an additional ‘last look’ at packages as they enter shipping cases giving them a greater level of insight into what is in the case without having to either physically open, investigate,and verify the contents unit-by-unit, or infer what is contained in each bundle, case or pallet.While the former is excessively costly and impractical, the latter raises concerns in high-speed packaging operations, downstream warehousing, and supply chain activities, as it is based primarily on guesswork.And, with the intent of serialization laws and directives globally being to ensure the integrity of both the physical package and the serialization data to ensuring a safe and effective supply chain, inference is simply not good enough.

For many years,automated inline vision inspection has been used for item verification as well as lot and expiration code inspections. By implementing aggregation, operators gain an additional ‘last look’ at packages as they enter shipping cases giving them a greater level of insight into what is in the case without having to either physically open, investigate,and verify the contents unit-by-unit, or infer what is contained in each bundle, case or pallet.While the former is excessively costly and impractical, the latter raises concerns in high-speed packaging operations, downstream warehousing, and supply chain activities, as it is based primarily on guesswork.And, with the intent of serialization laws and directives globally being to ensure the integrity of both the physical package and the serialization data to ensuring a safe and effective supply chain, inference is simply not good enough.

Moreover, the total supply chain visibility offered by aggregation presents the industry with the opportunity to make significant logistical improvements. Real-time monitoring and access to the legacy data will enable companies to create a virtual mirror of the supply chain, improving visibility and allowing partners to streamline order forecasting and reduce wastage, improve warehouse management, and offer greater shipment visibility. In short, this could save companies a huge amount of time and money.

Complexity and cost vs opportunity

While introducing aggregation does increase the complexity and cost of serialization implementation, it is clear that the benefits far outweigh any initial investment concerns. Faster passage to market, cost cutting, additional supply chain security and increased patient safety are all advantages ofaggregation, and while itis not a legislative requirement in all markets at the moment, it is likely to become obligatory as countries adapt their serialization regulations moving forward.

By introducing aggregation as standard practice in serialization implementation, businesses can address multiple complexities within one project. Challenges can be overcome in a flexible and cohesive manner, allowing for an efficient return to business as usual.

References

1 Healthcare Distribution Alliance (HAD) Saleabe Returns Pilots Report, https://sv-db1.hdma.net/eweb/downloads/HDA%20Saleable%20Returns%20Pilots%20Report%202017.pdf,page 6