Historically, companies not keeping abreast of marketing trends have not fared well. Consider the demise of the once highly successful computer company Wang Laboratories.

Founded in 1951, the company at its peak in the 1980’s had annual revenues of $3 billion, employed over 33,000 people and was one of the leading companies worldwide. Unfortunately, not foreseeing the advent of the personal computer (PC), led to its demise. By August 1992, the company had filed for bankruptcy protection, was acquired, and by 2008, no longer existed as a distinct brand or division. Not unlike the computer industry, the pharmaceutical and biotechnology industry is equally subject to market trends. Not keeping abreast of them can have equally dire consequences. From Vetter’s perspective, we see a variety of trends occurring in a rapidly changing pharmaceutical and biotechnology industry that bear watching.

On the macro level, digital health is combined with mobile lifestyles. This includes the use of more convenient technology to deliver medication and information to patients and healthcare providers. This is especially true with the mobile phone. When we consider that approximately two-thirds of the world population already own such a device, digital health is clearly a significant trend.

From a therapy perspective, breakthrough therapies for medical needs are quickly on the rise. This is particularly relevant to the injectables market where nearly 40% of breakthrough the rapies are monoclonal antibodies (mAbs). Most of these therapies are used to treat cancer and orphan diseases. Chronic diseases such as diabetes also continue to increase worldwide, leading to an increased number of patients that require access to parenteral therapies.

Like our earlier example, being aware of these trends is essential for survival as a company and for the industry itself. Following are some of the consequences market developments have on pharmaceutical service providers:

- Companies must adapt and enhance their service portfolio

- Partnering with others with complementary expertise by means of working in teams comprised from various companies able to address complex market requirements is essential

- Greater support for customers in the development of breakthrough therapies by providing speed, flexibility, and valuable expertise with complex high value therapies is in high demand

Consider what is at stake. A recent Zion Market Research report estimates that the global injectable drug delivery market is expected to grow from $444 billion in 2018, reaching nearly $932 billion with a CAGR of 11.2% by the year 2025. Geographically speaking, it is estimated that North America will continue to be the holder of the largest share for the market during the forecasted period. The rise in chronic diseases is the catalyst to this growth, as well as the number of companies that are focused on collaboration and partnerships that enable the availability of high-value products.

The orphan drug sector will also double in size by 2024 with VC funding taking aim at oncology, rare diseases and high prevalent chronic diseases. Smaller biotech companies are in good financial shape. With venture capital funding accelerating in 2017, they have been able to maintain their pace of outsourcing spends. It also helps that the injectable share of all therapeutic NDA/BLA approvals has increased in recent years, with further positive development expected until 2024.

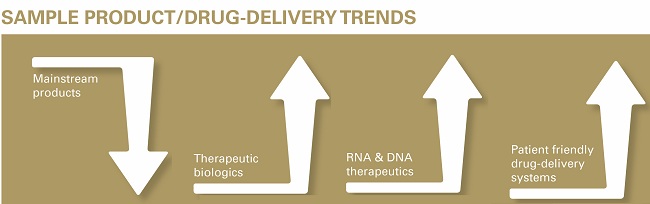

Looking at indications, we are faced with the likelihood that the mainstream approach toward simple to manufacture molecules is now yesterday’s thinking. The reason for this is that more and more drugs are targeted on an increasing individual basis towards small, specific groups. A consistently greater number of therapeutic biologics have been approved in the market over the last few years. By their very nature, these compounds are complex in their handling.

Increasingly, parenterals are being supplied in drug-delivery systems that are more patient friendly such as prefilled syringes or auto-injectors. Many component suppliers are providing ready to use components that offer advantages to manufacturers. This change in components requires vigilant oversight of the involved suppliers. As a consequence of the global nature of the business, the overall supply chain of a drug product is increasingly challenging. Today, many active ingredients, components and excipients often come from a variety of suppliers around the world.

There will always be a wide variety of trends influencing our industry and we see no reason why this will not continue well into the future. It is the nature of our industry and we will always do our best to meet these needs successfully. With the continued support of industry experts and their promising solutions, be they analogous or digital, we are in the position to successfully navigate our future.